All Categories

Featured

Table of Contents

Home loan life insurance supplies near-universal insurance coverage with very little underwriting. There is commonly no medical exam or blood sample needed and can be a valuable insurance coverage plan option for any type of property owner with serious preexisting clinical conditions which, would certainly avoid them from purchasing typical life insurance policy. Other advantages include: With a home mortgage life insurance coverage plan in position, heirs will not have to stress or wonder what could happen to the family home.

With the mortgage repaid, the family members will constantly have a location to live, given they can manage the residential property tax obligations and insurance coverage each year. policy mortgage.

There are a few various types of mortgage protection insurance coverage, these include:: as you pay even more off your mortgage, the amount that the policy covers reduces in accordance with the superior equilibrium of your mortgage. It is the most common and the least expensive form of home mortgage protection - do i need mortgage insurance canada.: the quantity insured and the costs you pay continues to be degree

This will certainly pay off the mortgage and any remaining balance will most likely to your estate.: if you want to, you can include significant disease cover to your home loan protection plan. This suggests your mortgage will certainly be cleared not only if you die, yet likewise if you are identified with a severe health problem that is covered by your policy.

Home Mortgage Group Insurance

Furthermore, if there is an equilibrium continuing to be after the home mortgage is removed, this will certainly most likely to your estate. If you change your home loan, there are a number of things to consider, relying on whether you are covering up or expanding your home mortgage, switching, or paying the home loan off early. If you are covering up your home mortgage, you need to make sure that your policy satisfies the brand-new worth of your home mortgage.

Contrast the prices and benefits of both alternatives (us mortgage insurance). It might be more affordable to maintain your initial home loan protection policy and after that buy a 2nd policy for the top-up quantity. Whether you are covering up your mortgage or extending the term and require to get a new plan, you might find that your premium is greater than the last time you got cover

Mortgage Income Protection

When changing your home loan, you can assign your home loan protection to the new lending institution. The premium and degree of cover will certainly coincide as prior to if the amount you obtain, and the term of your home loan does not change. If you have a plan with your lending institution's group plan, your loan provider will certainly terminate the plan when you switch your mortgage.

In California, home loan protection insurance coverage covers the whole outstanding equilibrium of your funding. The fatality advantage is an amount equal to the balance of your home loan at the time of your death.

Mortgage Protection Insurance Agent Salary

It's important to comprehend that the fatality benefit is provided straight to your lender, not your liked ones. This assures that the remaining financial debt is paid completely and that your liked ones are saved the financial strain. Home loan protection insurance coverage can additionally provide short-lived coverage if you end up being handicapped for an extensive period (generally 6 months to a year).

There are many benefits to obtaining a home loan protection insurance coverage in California. Several of the leading advantages consist of: Ensured authorization: Also if you remain in inadequate health or operate in a harmful career, there is ensured approval with no medical exams or lab tests. The exact same isn't real permanently insurance policy.

Disability security: As specified over, some MPI policies make a couple of home loan payments if you come to be handicapped and can not bring in the very same income you were accustomed to. It is necessary to keep in mind that MPI, PMI, and MIP are all various sorts of insurance coverage. Home mortgage protection insurance policy (MPI) is created to pay off a home mortgage in case of your fatality.

Mortgage Protection Leads For Sale

You can also use online in minutes and have your policy in position within the exact same day. To find out more concerning getting MPI protection for your home financing, call Pronto Insurance coverage today! Our experienced agents are right here to answer any concerns you might have and offer further assistance.

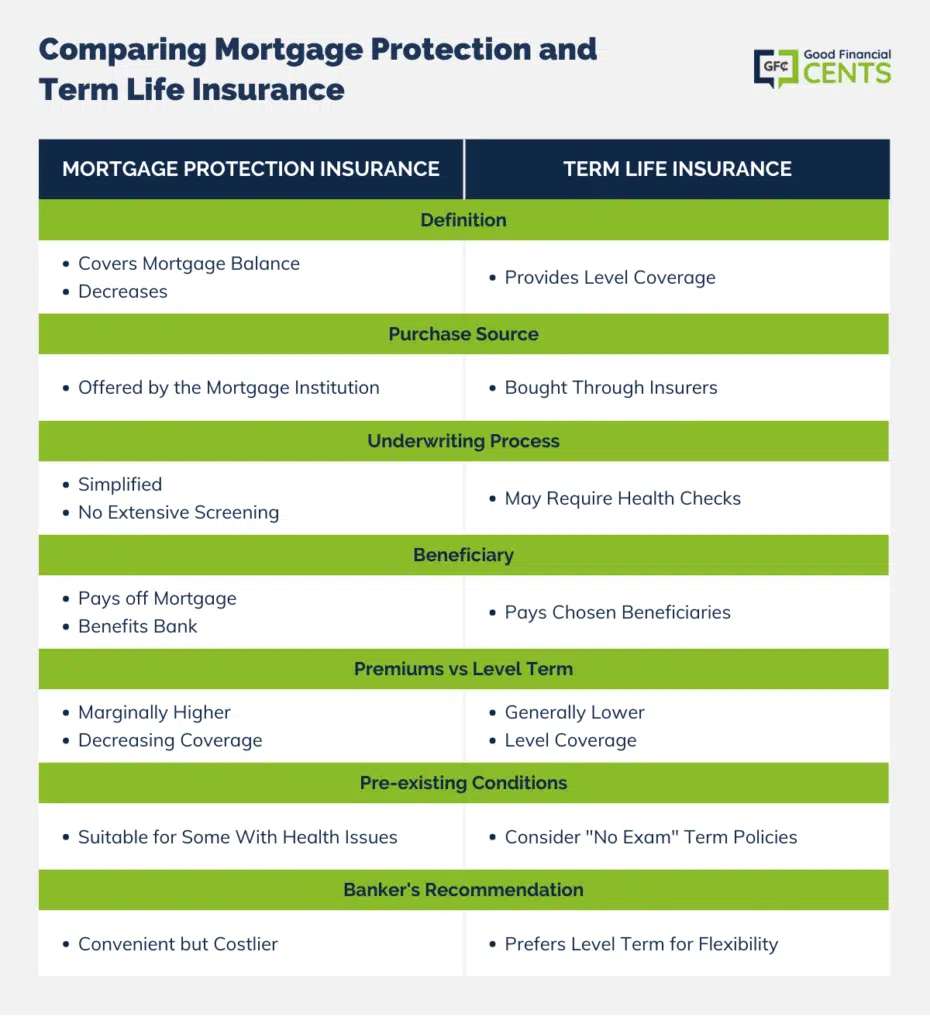

MPI provides several advantages, such as peace of mind and simplified certification procedures. The fatality benefit is directly paid to the loan provider, which limits versatility - mortgage life insurance sales. In addition, the advantage quantity lowers over time, and MPI can be extra costly than common term life insurance policy plans.

Mortgage Protection Insurance Costs

Get in fundamental info about on your own and your home loan, and we'll compare rates from different insurers. We'll likewise reveal you just how much protection you need to safeguard your mortgage. So begin today and offer yourself and your household the comfort that features knowing you're shielded. At The Annuity Expert, we understand property owners' core issue: guaranteeing their family can maintain their home in the occasion of their fatality.

The primary advantage here is quality and self-confidence in your decision, understanding you have a plan that fits your requirements. As soon as you accept the strategy, we'll take care of all the documents and setup, making certain a smooth implementation process. The positive result is the assurance that includes recognizing your family is protected and your home is safe and secure, no matter what happens.

Professional Suggestions: Assistance from skilled specialists in insurance policy and annuities. Hassle-Free Arrangement: We manage all the documents and execution. Economical Solutions: Locating the very best coverage at the most affordable feasible cost.: MPI specifically covers your home mortgage, offering an extra layer of protection.: We function to discover the most affordable services tailored to your budget.

They can give info on the coverage and advantages that you have. Generally, a healthy individual can anticipate to pay around $50 to $100 each month for home loan life insurance policy. It's suggested to get a personalized home loan life insurance quote to obtain a precise quote based on individual circumstances.

Latest Posts

Final Expense Life Insurance Policy

Funeral Plans With No Waiting Period

Best Cremation Insurance